Introduction to the BCG Matrix

The BCG Matrix, also known as the Boston Consulting Group Matrix, is a strategic management tool that assists organizations in analyzing their portfolio of products or business units. Developed in the early 1970s by the Boston Consulting Group, this matrix offers a simple yet powerful framework for evaluating the potential of various offerings based on two critical dimensions: market growth rate and relative market share.

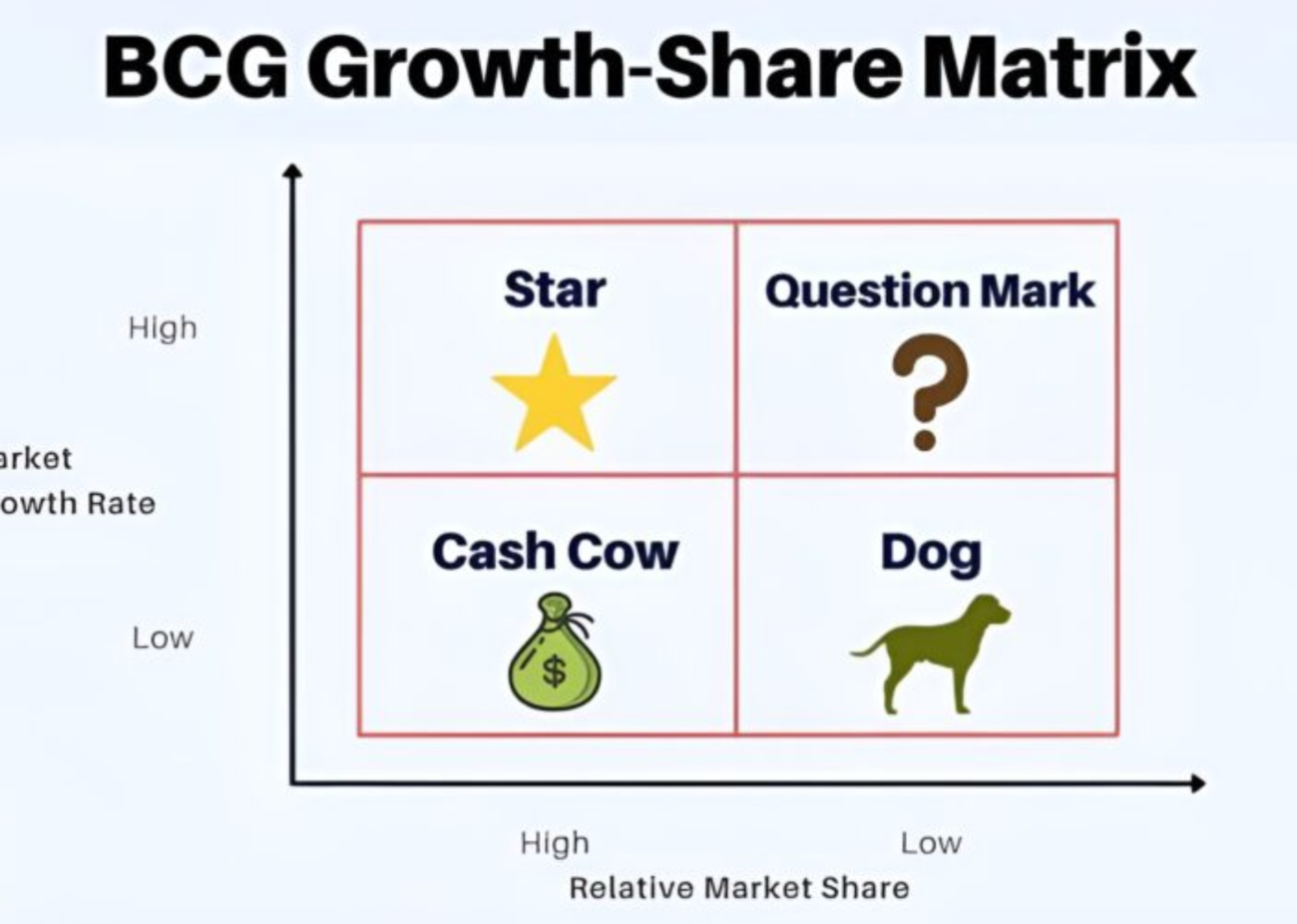

The BCG Matrix categorizes products or business units into four distinct quadrants: Stars, Cash Cows, Question Marks, and Dogs. Each quadrant represents a different strategic position based on a product’s market growth potential and its current share within the market. This structured approach enables business leaders to make informed decisions regarding resource allocation, investment priorities, and overall portfolio management.

The purpose of the BCG Matrix extends beyond mere categorization; it provides valuable insights into the lifecycle of products and helps companies strategize for future growth. For instance, products positioned as Stars require significant investment to maintain their growth trajectory, while Cash Cows generate steady revenue with little investment. Conversely, products in the Question Marks quadrant may present opportunities for growth but necessitate careful consideration of resource investment, while Dogs may require divestment or restructuring.

In essence, the BCG Matrix serves as a vital tool for businesses seeking to optimize their product portfolios and enhance their competitive advantage. By evaluating products through this lens, companies are better equipped to make strategic decisions that align with their long-term goals, ensuring sustainable growth in an ever-evolving marketplace. The utility of the BCG Matrix lies in its simplicity and clarity, making it an indispensable resource for organizations looking to navigate the complexities of market dynamics.

Components of the BCG Matrix

The BCG Matrix, developed by the Boston Consulting Group, is a strategic tool used to evaluate a company’s portfolio of products based on their market growth rate and relative market share. Within this framework, four distinct categories emerge: Stars, Question Marks, Cash Cows, and Dogs. Each of these categories possesses unique characteristics that inform business strategy and investment decisions.

Firstly, Stars are products that exhibit high market share in a rapidly growing industry. These products require significant investment to maintain their market lead and capitalize on growth prospects. The strategic emphasis for Stars is to nurture them further to ensure they continue to thrive, thereby establishing a strong competitive position that could eventually transform them into Cash Cows as market growth stabilizes.

Next, Question Marks, or Problem Children, refer to products with low market share in high-growth markets. This category embodies uncertainty, as it is unclear whether these products will gain traction or fade away. Businesses must perform a careful analysis to determine whether to invest in these products to enhance their market share or to divest them if potential growth isn’t promising. A well-planned strategy can help convert Question Marks into Stars, driving future revenue.

The third category, Cash Cows, symbolizes products with high market share in slow-growing or mature markets. These products are often the most profitable, generating a substantial cash flow with minimal investment. The objective here is to maximize returns while minimizing investment as they yield strong profit margins, which can be reallocated to support Stars and Question Marks.

Finally, Dogs are products that possess low market share in stagnant or declining markets. These offerings typically do not generate significant profits and often require more resources than they return. Businesses may choose to divest or discontinue such products to refocus their attention on more promising areas. Understanding these four categories enables companies to effectively strategize their portfolio management, aligning their investments with market dynamics.

Creating a BCG Matrix: A Step-by-Step Guide

To effectively utilize the BCG Matrix as a strategic tool for business growth, it is essential to follow a systematic approach in its creation. The first step involves identifying the products or business units you wish to analyze. This identification should encompass a comprehensive list of all relevant offerings within your organization. It is crucial to consider both established products and new or upcoming entries that may play a significant role in the business portfolio.

Next, gather and analyze data on market growth and market share for each identified product. Market growth can be determined by examining industry reports, market analysis studies, or internal sales data, while market share is typically derived from sales figures relative to competitors. This quantitative analysis will provide a clearer picture of where each product stands within the marketplace. Accurate data collection and analysis are vital for the effectiveness of the BCG Matrix.

Once the necessary data has been collected, the next step is plotting the products on the BCG Matrix, which consists of four quadrants: Stars, Questions Marks, Cash Cows, and Dogs. Each quadrant represents different strategic implications based on the product’s market share and market growth. For example, products categorized as Stars exhibit high market growth and share, while Dogs display low performance in both aspects. Plotting your products correctly will allow for a visual representation of your business portfolio.

Finally, interpreting the results of the BCG Matrix involves analyzing the placement of each product. This analysis requires strategic decision-making regarding resource allocation, potential investments, and divestment opportunities. By understanding the implications of each quadrant, businesses can prioritize their efforts and strategically channel resources into high-potential areas. This systematic approach to creating the BCG Matrix not only aids in decision-making but enhances overall business growth strategies.

Analyzing Market Growth

Market growth serves as a critical criterion in evaluating a company’s business strategy, particularly when employing the BCG Matrix. Market growth is generally measured by the rate of change in sales or demand for a specific product or service over a given period. Factors that contribute to market growth include economic conditions, technological advancements, demographic shifts, and changes in consumer preferences. For businesses, understanding these factors is essential as they impact product positioning and resource allocation.

In the context of the BCG Matrix, a product categorized as a ‘Question Mark’ is one that operates in a rapidly growing market but holds a relatively low market share. This positioning indicates that while there is significant potential for growth, the product requires substantial investment to increase its market share. Analyzing market growth for ‘Question Marks’ is vital as it helps businesses make decisions about whether to invest in these products or divest to allocate resources to more promising areas.

On the other hand, products classified as ‘Stars’ are those that enjoy high market share in high-growth markets. These products are typically leaders in their respective sectors and contribute significantly to revenue. However, sustaining their position requires continuous investment to fend off competition and capitalize on market opportunities. Therefore, monitoring market growth is essential to ensure that ‘Stars’ retain their competitive advantages.

In conclusion, effective analysis of market growth enables companies to utilize insights from the BCG Matrix to guide strategic decision-making. By understanding the dynamics of market growth, businesses can better classify their products and allocate resources wisely to foster long-term business growth and sustainability.

Understanding Market Share

Market share is a crucial metric in assessing a company’s competitiveness within its industry. It is defined as the percentage of an industry or market’s total sales that is earned by a particular company over a specified time period. The calculation of market share is relatively straightforward; it can be determined by dividing the company’s sales revenue by the total sales revenue of the industry, then multiplying by 100 to obtain a percentage. For example, if a company’s sales are $20 million and the total market sales are $100 million, the market share would be 20%.

The significance of market share cannot be overstated. A higher market share typically signifies a stronger competitive position, allowing for greater economies of scale, more effective branding, and enhanced pricing power with suppliers and customers alike. This metric is also a reflection of customer loyalty and brand strength. However, it is essential to interpret market share within the context of profitability, as not all market shares are created equal.

In the context of the BCG Matrix, products categorized as ‘Cash Cows’ possess a high market share within a low-growth market. These products tend to generate more cash than the amount needed for maintenance, making them vital to fund other operations or innovations within the company. Conversely, ‘Dogs’ are characterized by low market share in a declining market, which typically leads to minimal returns and can drain resources. Understanding this relationship between market share and profitability is vital for informed decision-making, ensuring that businesses can strategically allocate resources for maximum growth.

Strategic Implications of Each Category

The BCG Matrix classifies business units and products into four key categories: Stars, Cash Cows, Question Marks, and Dogs, each reflecting distinct strategic implications that are critical for informed decision-making. Understanding these classifications can help organizations leverage their resources effectively and tailor their strategies accordingly.

Stars represent high-growth markets with high market share. Products classified as Stars require continuous investment to sustain their leading positions and capitalize on market growth. Businesses should prioritize these products by reinforcing their market presence through aggressive marketing and innovation. Allocating resources judiciously can facilitate the transition of Stars into future Cash Cows.

Cash Cows are characterized by low growth but high market share. For these products, the primary strategy should be to optimize profitability while minimizing investment. Since Cash Cows generate excess cash, companies can reinvest this capital into Stars or Question Marks. It is essential to avoid complacency and ensure that Cash Cows remain competitive, thus prolonging their profitability.

Question Marks, or Problem Children, pose a unique strategic opportunity. While they reside in high-growth areas, their low market share indicates uncertainty. Businesses need to assess whether to invest heavily to increase market share or to divest. A focused strategy on market analysis and potentially reallocating resources can turn Question Marks into Stars, but this requires careful and timely decision-making.

Lastly, Dogs, which have low growth and low market share, often drain organizational resources through negative cash flow. A prudent approach for businesses managing Dogs is to consider divestment or resource reallocation to more promising categories. However, if Dogs still serve a strategic purpose, such as maintaining a competitive advantage, continued support may be justified.

In essence, understanding the strategic implications of each category within the BCG Matrix enables businesses to enact effective management strategies tailored to their products, balancing risk and opportunity to achieve sustainable growth.

Limitations of the BCG Matrix

The BCG Matrix, while widely utilized as a strategic tool for business growth, possesses certain limitations that merit careful consideration. One of the primary criticisms is its tendency towards oversimplification. The matrix categorizes business units into four quadrants based solely on market share and market growth. This binary view can overlook the complexities and nuances inherent in different industries and competitive landscapes. Businesses may not fit neatly into these categories, rendering the analysis less effective for strategic decision-making.

Additionally, the BCG Matrix is often criticized for its static analysis. The framework typically presents a snapshot of a company’s market positioning at a given point in time. However, market dynamics are constantly evolving due to factors such as technological advancements, shifts in consumer preferences, and changing competitive strategies. As a result, relying solely on the BCG Matrix can lead to outdated strategies that fail to adapt to new realities in the marketplace.

Another notable limitation is its limited focus on internal and external factors outside of market share and growth. Factors such as economic conditions, regulatory environments, and technological disruptions can significantly influence a company’s performance and growth potential. The BCG Matrix does not adequately account for these external variables, which may lead businesses to make misguided strategic choices based solely on the framework’s output.

Furthermore, the matrix may promote a short-term focus on financial performance rather than fostering long-term sustainable growth. Companies using the BCG Matrix might prioritize high-growth products while neglecting investments in innovation or core competencies that lead to sustained success. These limitations suggest that while the BCG Matrix can provide valuable insights, it should not be the sole tool guiding strategic decision-making in an organization. A more holistic approach that considers a variety of factors is essential for effective strategy development.

Real-World Applications of the BCG Matrix

The BCG Matrix has been widely adopted by various companies as an effective strategic tool for optimizing their product portfolios and fostering growth. One notable example is the technology giant Apple Inc., which has effectively used the BCG Matrix to manage its diverse range of products. By categorizing its offerings into Stars, Cash Cows, Dogs, and Question Marks, Apple has been able to focus its resources on high-potential products like the iPhone and iPad while continuing to generate significant revenue from established product lines such as the Macintosh computers. This strategic alignment has allowed Apple to remain a leader in the competitive technology sector.

Another illustrative case is that of The Coca-Cola Company. Utilizing the BCG Matrix, Coca-Cola strategically manages an extensive portfolio of beverages. The company identifies its flagship products, such as Coca-Cola Classic, as Cash Cows that continue to yield consistent profits. In contrast, newer products in the portfolio, like Coca-Cola Zero Sugar, may initially fall into the Question Marks category, where the company must gauge market potential and invest strategically to enhance growth. Coca-Cola’s adept monitoring of its product lines has enabled it to remain adaptive and responsive to changing consumer preferences, thereby sustaining its market position.

Additionally, Procter & Gamble (P&G) provides a remarkable example of employing the BCG Matrix for strategic decision-making. By analyzing its various consumer goods, P&G has effectively allocated marketing resources to high-growth products while phasing out underperforming items. This application helps the organization streamline its operations and ensure that funds are directed towards products with the highest potential for market share growth and profitability. As a result, P&G has remained an influential player in the consumer goods industry, leveraging the BCG Matrix to navigate market dynamics efficiently.

Conclusion and Future Outlook

In the realm of strategic planning, the BCG Matrix serves as a vital framework that assists businesses in evaluating their product portfolio. By categorizing products into four distinct quadrants—Stars, Cash Cows, Question Marks, and Dogs—the BCG Matrix provides organizations with insights to allocate resources effectively and prioritize their market strategies. This tool not only aids in identifying high-potential products but also guides decision-making processes in resource allocation to ensure sustained growth.

The significance of the BCG Matrix extends beyond mere categorization; it also informs strategic shifts as companies respond to changing market dynamics. In today’s rapidly evolving business landscape, adaptability is paramount. Organizations must be ready to revisit their BCG analysis regularly to account for fluctuations in market share and growth rates. For example, a product positioned as a Cash Cow may face increased competition, requiring strategic investment to maintain its profitability.

Looking forward, companies can enhance their use of the BCG Matrix by integrating it with other analytical tools such as SWOT analysis or market trend evaluations. This combination allows businesses to gain a multifaceted view of their operational environment, ensuring that decisions are informed by comprehensive data. Moreover, as markets become increasingly digital and consumer behavior shifts, companies must incorporate real-time analytics into their BCG assessments to remain competitive.

In conclusion, the BCG Matrix remains a foundational tool for businesses aiming for strategic growth. As companies navigate future opportunities and challenges, leveraging this matrix alongside modern analytical techniques will empower them to make informed decisions, optimize their product portfolios, and ultimately achieve sustainable success.

Leave a comment

You must be logged in to post a comment.